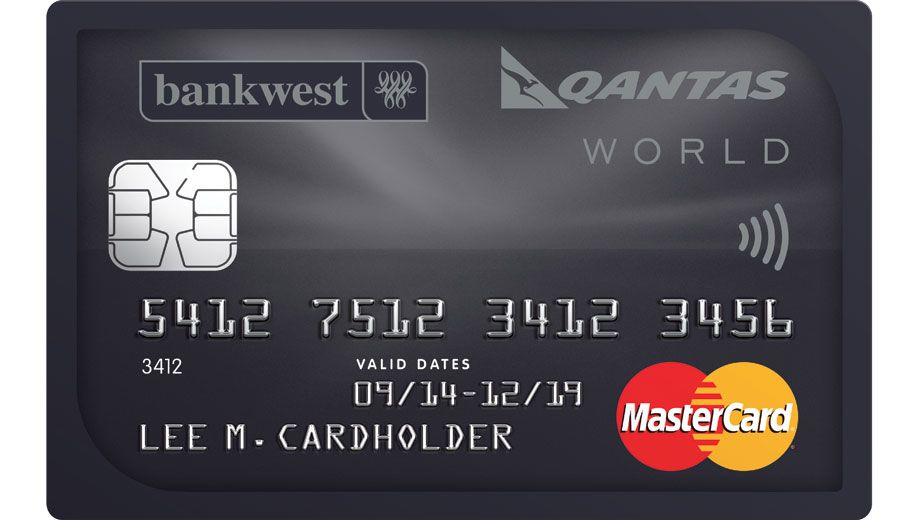

Bankwest unveils Qantas World MasterCard credit card

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

EXCLUSIVE | Bankwest has long had a ‘secret’ credit card – the Bankwest Qantas World MasterCard – but unless you were an existing customer chosen for an upgrade, there was never a way to apply for Bankwest’s top plastic.

That was, until now. In a rejig of the bank’s credit card line-up, the Qantas World MasterCard is finally open to brand new applicants, including those who don’t currently bank with Bankwest.

Positioned a rung above the existing Bankwest Qantas Platinum MasterCard, the Qantas World MasterCard carries a $270 annual fee and a minimum credit limit of $12,000, in line with many other Black-level cards in the Australian market.

New customers to Bankwest are enticed with a sign-up offer of 50,000 Qantas Points after spending at least $2,500 within the first three months, while all World cardholders can earn 0.66 Qantas Points per dollar spent: uncapped and without any monthly tiering.

Jetsetters will also appreciate paying no international transaction fees on foreign spend, a fast-track to Starwood Preferred Guest Gold after spending just one night in Starwood hotels like Westin, Sheraton and St. Regis, plus the expected travel insurance and credit card concierge service.

As part of the shuffle, the Bankwest Qantas Gold MasterCard is no longer available to new applicants, while the bank’s ‘other’ secret card – the Bankwest More World MasterCard – is also now open for all, but comes without an airline frequent flyer program partner.

Also read: November's top Qantas Frequent Flyer credit card sign-up offers

Connect with other business travellers in our Qantas discussion group

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

05 May 2016

Total posts 619

Nice that points are earn on foreign transactions but not sure I want to tie up so much monthly limit on a card with a poor earn when not abroad.

09 Jan 2016

Total posts 44

Yep, anything less than 1:1 points earn doesn't cut it and wont get me. For $270 p.a youi want at least that!

QFF

12 Apr 2013

Total posts 1518

Cannot agree more - $270 for measly 0.66 p/$? They can wait for me till next century!

Qantas - Qantas Frequent Flyer

23 Dec 2015

Total posts 26

I've just upgraded my Platinum card to the new World card. As my partner is International cabin crew and the fact we travel overseas a lot, this card it a great way to earn points of foreign current spend (only). They don't charge for additional cardholders either so, aside from my partner, I arranged for my Dad to be an additional cardholder for when he travels or buys things oversea. He saves the fees, I get the points, and he pays me back. Perfect arrangement.

Jetstar Airways - Qantas Frequent Flyer

29 Jul 2015

Total posts 2

Bankwest Qantas Platinum gives me all that I need. I am spending more than 6 months a year abroad and the card is the first manner of payment for all ( including household costs ) costs. No foreign exchange fees ! - wonderful - just a fair exchange rate. Travel insurance is very generous ( up to six months ) - frequent flyer points are about the 4th or 5th consideration. Bank service is good and credit limit quite adequate. Searched them all - for my circumstances, the best.

Qantas - Qantas Frequent Flyer

26 May 2014

Total posts 465

On the comments from V Champion and Serg, until recently I did get 1:1 points on this card, but like all Visa/MasterCard cards it has been wound back. Still compares favourably to other Visa/MasterCard cards. Sure I get 1.5:1 on Amex, but that is often not offered or offered with a too-high surcharge. I also view the saving on foreign exchange transactions as more valuable than the points.

Hi Guest, join in the discussion on Bankwest unveils Qantas World MasterCard credit card