Review: Commonwealth Bank Business Platinum Awards AMEX, MasterCard

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Notes

The Good

- Earn up to 1.5 frequent flyer points per dollar spent

- Complimentary travel insurance and other cover

The Bad

- Points cap applies after $100,000 of American Express spend

- Qantas Points attract an extra charge and accrue at a lower rate than Velocity

Added Value

- Personal liability makes it easier for new businesses to apply

Introduction

If you have an ABN and run your own business, take a look at the Commonwealth Bank's Business Platinum Awards credit cards, pairing an American Express and a MasterCard on the one account for maximum acceptance, but with only one payment to make each month from a single bank statement which itemises all of your purchases.

Don't fret if you haven't been in business long, either – these are considered 'personal liability' credit cards where the responsibility for paying falls to the accountholder as an individual, not the business itself, which means you don't even need to share your business financials, balance sheets or profit and loss statements to apply.

What's more, you can earn up to 1.5 frequent flyer points per dollar spent and there are of course the usual Platinum-grade inclusions like travel insurance and extended warranty cover, but which can also apply to business goods purchased using either card.

Commonwealth Bank Business Platinum Awards: fast facts

- Grade/tier: Platinum

- Card type: American Express + MasterCard

- Loyalty program: Qantas Frequent Flyer Direct or Commonwealth Awards (convert to Virgin Australia Velocity)

- Qantas Points earned per A$1 spent (AMEX/MasterCard) via opt-in: 1.2/0.4

- Or, CBA Awards points earned per A$1 spent (AMEX/MasterCard): 3.0/1.0

- 3 CBA Awards points = 1.5 Virgin Australia Velocity Points (2:1 conversion)

- 1 CBA Awards point = 0.5 Velocity Points

- Points capping/tiering: Earn up to 120,000 Qantas Points per calendar year, or 300,000 CBA Awards points (150,000 Velocity points)

CBA Business Platinum Awards: fees, charges and interest

- Annual fee: $300

- Additional annual fee to earn Qantas Points: $30

- Additional/supplementary cardholder fee: $75/year

- Interest rate on purchases: 20.74% p.a.

- Interest-free days on purchases: Up to 55

- Interest rate on cash advances: 21.74% p.a.

- Total international transaction fee: 3.5% AMEX, 3.0% MasterCard

- Minimum income requirement: No defined minimum (personal liability)

- Minimum credit limit: $5,000

Earning points for free flights:

How you earn frequent flyer points depends on your reward choice: you can either use the default Commonwealth Awards program and manually convert your points to Virgin Australia Velocity on a 2:1 basis, or can opt for 'Qantas Frequent Flyer Direct' and have your points swept across automatically each month.

Choose CBA Awards with Velocity and every dollar spent on the Business Platinum Awards American Express card earns the equivalent of 1.5 Velocity Points per dollar spent – a very high and competitive earning rate – while using the companion MasterCard reels in a lesser 0.5 Velocity points per dollar.

That means you'd earn enough points for a near-free economy flight from Sydney to Melbourne from every $5,200 spent on the AMEX or every $15,600 spent on the MasterCard.

Prefer the Qantas Frequent Flyer program? You'd instead scoop up a lower 1.2 Qantas Points per dollar spent via AMEX and 0.4 Qantas Points per dollar when using the MasterCard while also paying $30 more in fees each year.

You'd also need to spend $6,667 on the American Express card to unlock a comparable Sydney-Melbourne economy class flight with Qantas or $20,000 on the MasterCard for the same, so choose your reward option carefully.

Whatever your decision, one great thing about CBA Business Awards is that payments to the Australian Taxation Office earn points at full rates – so whip our your AMEX and you could be earning 1.5 Velocity Points or 1.2 Qantas Points per dollar on payments to the tax man, up to the card's yearly earning cap.

Airport lounge access:

Complimentary airport lounge access isn't part of the parcel.

Complimentary insurance coverage:

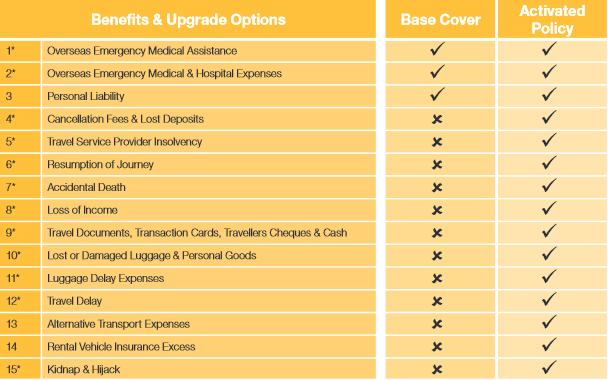

As you'd find of many personal credit cards, the CBA Business Platinum Awards duo comes with complimentary international travel insurance – you just need to remember to activate it via the CBA website before each overseas trip.

Activate that cover only after you've left Australia and you'll be subjected to a three-day waiting period, during which only the 'Base Cover' is provided until the 'Activated Policy' kicks in.

Provided you remember to activate, this is actually a great option for business travellers who might be flying on tickets booked by a client or using frequent flyer points, as many other credit card insurance policies require that pay for your return flights using the card to receive any cover.

During the activation process, you're also given the option to purchase extra cover for snow sports, cruises, pre-existing medical conditions and more, without taking out separate insurance cover.

You'll also receive up to a year of extended warranty cover on certain appliances and other business goods purchased using your CBA Business Platinum AMEX or MasterCard, plus interstate flight inconvenience insurance and transit accident insurance.

Goods purchased using your card (including business goods) may also covered for loss, theft and damage anywhere in the world for 90 days from the date of purchase via the bank's purchase security insurance, while there's a 'guaranteed pricing scheme' too whereby you can request a partial refund if something you buy is later advertised at a lower price.

CBA Business Platinum Awards: the verdict

With an earn rate of up to 1.5 frequent flyer points per dollar spent (including with the ATO) and travel insurance that provides cover regardless of how your trip was paid for, a CBA Business Platinum Awards credit card account could well pay for itself.

That's because you'd be saving money by not having to purchase travel insurance for yourself with every trip (or every year on an annual policy), and you can use the points you earn on the card towards free flights to keep your costs down.

It's also possible to use both Qantas and Velocity Points for flight upgrades – so you could well use your card to buy an economy fare and use the points you've earned for a business class upgrade (subject to availability and the terms of each program), which either reduces your travel expenditure or sees you arriving at your destination refreshed and ready to run.

The only major drawback here is CBA's yearly points cap of 120,000 Qantas Points or 300,000 Awards Points (=150,000 Velocity Points), which you'll reach after spending $100,000 on the AMEX.

For a personal card, that'd be a reasonably generous points cap – but for a business card and especially if you have a supplementary cardholder also charging their business expenses to the account, you could find yourself reaching that ceiling well before December 31 each year, so do your sums before you apply.

Also read: Commonwealth Bank Diamond Awards (personal) American Express, MasterCard review

Connect with other business travellers in our credit card discussion group

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Hi Guest, join in the discussion on Commonwealth Bank Business Platinum Awards AMEX, MasterCard