Your guide to the Citibank Rewards credit card program

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

With airline partners including Virgin Australia, Singapore Airlines and Emirates, Citibank Rewards is a must-know program for credit card spenders keen to collect points, but who need flexibility in which airline frequent flyer program they’re ultimately shipped to.

For example, most Citibank cardholders first accrue Citibank Rewards points and can later manually convert them to the airline of their choice, with more favourable conversion rates and a longer list of partners offered to customers with Citi’s more expensive cards.

But with different and sometimes confusing ‘earn and burn’ rates for the various credit card tiers and that extra list of airline partners for Prestige cardholders, we put Citibank Rewards under the microscope to make sense of it for you, the traveller.

Citibank Rewards 101

Points in the Citibank Rewards program can be earned on a range of Citibank cards including the Citi Classic, Citi Rewards Platinum, Citi Signature and Citi Prestige cards from the current line-up.

Cards which earn points directly with an airline such as the Emirates Citi World MasterCard and the Citi Qantas Visa Signature card don’t utilise Citibank Rewards, nor do Citi’s other cards when opting to directly earn Qantas frequent flyer points.

For cards that do earn Citibank Rewards points, the number earned per dollar spent varies as follows:

- Citi Classic: One point per $1 spent, capped at $5,000/month within Australia and uncapped overseas

- Citi Rewards Platinum: 1.25 points per $1 spent, up to $10,000/month on domestic spend with no cap on foreign spend

- Citi Signature: 1.5 points per $1 on home soil, with a monthly cap of $20,000 for local transactions and uncapped when abroad

- Citi Prestige: Two points per dollar in Australia, five points per A$1 internationally, both uncapped

The rates above apply to all new Citibank customers. Existing customers may be earning points at different rates with varying capping rules, which can be confirmed by contacting Citibank directly.

Citibank Rewards: earning frequent flyer points

‘Five points per dollar’ is a great attention-grabber, but when frequent flyer points are the goal the conversion rates from Citibank Rewards to the various airline programs are what’s most important.

For starters, while the Citi Classic card is indeed part of Citibank Rewards, these customers can’t convert their points across to an airline partner – instead redeeming them for goods and services available via the Citibank Rewards catalogue.

The news is more promising for Citi Rewards Platinum cardholders where two Citi Rewards points currently equals one Virgin Australia Velocity point or one Singapore Airlines KrisFlyer mile, with a minimum transfer amount of 20,000 Citi Rewards points (10,000 airline frequent flyer points).

However, this will change from March 18 2016, from which time you'll need 2.5 Citi Rewards points for every airline frequent flyer point and must transfer at least 25,000 Citi Rewards points at a time (10,000 frequent flyer points)

Higher up the chain, Citi Signature gains a partner in Emirates Skywards with the same 2.5 Citi Rewards points netting one Skywards mile, while the conversion rate for Virgin Australia and Singapore Airlines today stands at 1.5 Citi Rewards points = 1 Velocity point or KrisFlyer mile.

Simialrly, that becomes less favourable from March 18 in changing to a 2:1 ratio, with the Signature's current 15,000-point transfer minimum also bumped up to 20,000 Citibank Rewards points.

Citi Prestige has the longest list of airline and hotel partners, pairing the more favourable Citi Signature rates with a raft of other partners as follows:

- Air France/KLM Flying Blue: 2 Citi points = 1 mile

- Cathay Pacific Asia Miles: 2 Citi points = 1 mile

- Club Carlson: 1 Citi point = 1 Gold Point

- Delta SkyMiles: 2 Citi points = 1 mile

- Emirates Skywards: 2.5 Citi points = 1 mile

- Etihad Guest: 2 Citi points = 1 mile

- EVA Air Infinity MileageLands: 3 Citi points = 1 mile

- GarudaMiles: 2 Citi points = 1 mile

- Hilton HHonors: 1 Citi point = 1 HHonors point

- IHG Rewards Club: 1.5 Citi points = 1 Rewards Club point

- Malaysia Airlines Enrich: 2 Citi points = 1 mile

- Qatar Airways Privilege Club: 2 Citi points = 1 Qmile

- Singapore Airlines KrisFlyer: 1.5 Citi points = 1 mile (2 Citi points = 1 mile from March 18 2016)

- Thai Airways Royal Orchid Plus: 2 Citi points = 1 mile

- Virgin Australia Velocity: 1.5 Citi points = 1 Velocity point (2 Citi points = 1 Velocity point from March 18 2016)

Read: Citi Prestige Visa Infinite credit card review

Again, a minimum transfer of 15,000 Citibank Rewards points currently applies per transaction – rising to 20,000 Citibank Rewards points in March – but with the exception of Cathay Pacific Asia Miles, with which you'll need just 5,000 Citibank Rewards points.

Convert Citi Rewards points to frequent flyer points

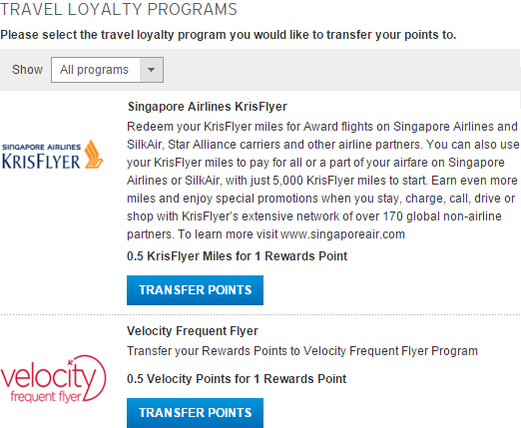

To get started, simply head to the Citibank Rewards website, login and look for ‘travel loyalty programs’ for your available options:

After amassing the minimum 15,000 Citibank Rewards points (or just 5,000 points for Asia Miles), you’ll then be able to convert your points to the airline or hotel program of your choosing, depending on the options available to your card type as above.

Although you can certainly transfer your points across as soon as you’ve passed the minimum threshold, it’s worth keeping in mind that some programs including Singapore Airlines KrisFlyer and Etihad Guest have strict points expiry rules which can see your balance wiped clean in just two to three years.

In that instance, it can make more sense to keep your points ‘warehoused’ with Citibank and any of your other credit card loyalty programs, and then transfer them across to your preferred airline as you become ready to use those points – as even if the 'bank to airline' conversion rate changes, you're still better off with some points in your account than an expired airline balance.

Citibank Rewards: earning bonus points

On top of what you’d usually earn on your card, Citibank also awards a further three Citibank Rewards points per dollar spent at a range of merchants across Australia spanning travel, retail, leisure and entertainment.

Among the list: Park Regis, Oaks and Emporium hotels; Salvatore Ferragamo; Bose; Red Balloon; Wilson Parking and Europcar.

By paying with your eligible Citibank credit card at these businesses and many others, it’s easy to skyrocket your Citibank Rewards balance – and then ultimately your frequent flyer balance – getting you that next free flight or upgrade to business class even sooner.

Also read: Citibank cuts frequent flyer points: what you need to know

Follow Australian Business Traveller on Twitter: we're @AusBT

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Virgin Australia - Velocity Rewards

19 Feb 2016

Total posts 14

Thanks Chris,

What do you guys think about leaving the points in Citi Rewards, and redeeming flights through the Citi Rewards program?

Eg. Virgin Australia flights:

I may be mistaken, but a flight, say 1/4/16 to 5/4/16 MEL-SYD return is around 34457 CitiReward points (requires a spend of approx $23000), and 20400 Converted to Velocity points (approx spend $27000).

Could someone please confirm these rough calculations.

Hi Guest, join in the discussion on Your guide to the Citibank Rewards credit card program