Woolworths Everyday Rewards Qantas credit card annual fee hike

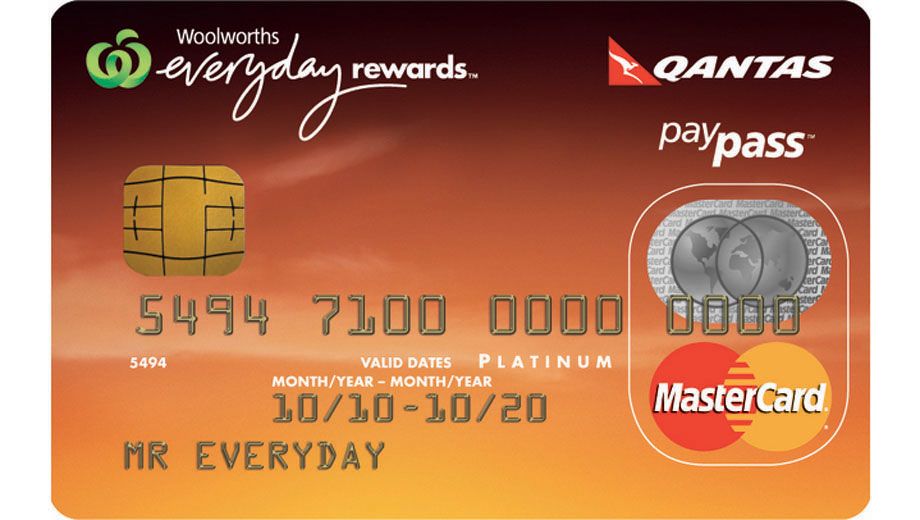

From later this month, the Woolworths Everyday Rewards Qantas MasterCard – currently one of Australia’s best credit cards for earning Qantas frequent flyer points on the cheap – will see a sharp rise in annual fees.

And, if you have your partner attached to the card, you’ll wind up paying almost double what you are today to earn Qantas points.

Come October 26 2014, the standard annual fee jumps from $89 to $139, while at the same time a new $29 annual ‘additional cardholder fee’ is being introduced.

The changes come as the current HSBC-issued Woolworths Everyday Rewards Qantas MasterCard becomes the Woolworths Money Qantas Platinum MasterCard, instead issued by Macquarie Bank.

Macquarie softens the blow in the first year with a reduced annual fee of $99 – a mere $10 more than customers are already paying to HSBC – although the additional cardholder fee will still apply.

To also ease the transition, cardholders won’t receive a new piece of plastic, a new credit card number or a new PIN: everything stays the same, bar a few changes to fees.

The Woolworths credit card is also becoming a tad more accessible to ‘everyday’ spenders, with a reduction in the minimum credit limit from $8,000 to $6,000.

For those earning lower incomes or working part-time, that greatly improves the chance of meeting at least the lower end of the bank's lending criteria.

As to Qantas frequent flyer points, a Woolworths Money spokesperson confirmed to Australian Business Traveller that there would be no changes to the card’s current Qantas Frequent Flyer earning rates, nor was a points earning cap being introduced as part of the transition.

Read our review of the existing card: Woolworths Everyday Rewards Qantas MasterCard

How it compares

With an additional cardholder on the Woolworths Money Qantas Platinum MasterCard, you'll pay a total of $168 after the first year, yet receive no travel insurance coverage or bonus points on international spend.

To compare, you could pay an extra $31 per year for the HSBC Qantas Platinum Visa – which earns the same number of points per dollar spent, has no extra fee for an additional cardholder and earns double points when using the card abroad.

You'll also be protected by free international travel insurance, activated after charging at least 90% of your return international airfare to the HSBC card, along with extended warranty coverage, a guaranteed pricing scheme and transit accident insurance.

While your annual earn is capped at 300,000 Qantas Points, you'll receive two free Qantas Club lounge passes each year, plus a cool 20,000 bonus points when you first use the card – easily repaying the additional $31 outlay.

Read our review: HSBC Qantas Platinum Visa

Follow Australian Business Traveller on Twitter: we're @AusBT

11 Mar 2012

Total posts 181

Should we jump onboard with the current (outgoing 16k bonus/hsbc issued) offer?

Hi Guest, join in the discussion on Woolworths Everyday Rewards Qantas credit card annual fee hike