Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Notes

The Good

- Up to 50,000 bonus frequent flyer points for new customers

- No spend requirement for overseas travel insurance, but you have to activate for each trip

The Bad

- Low earning rate on purchases, especially with overseas partner programs

- High annual fee given the low earn rate

Added Value

- Convert CBA Award points to 13 partner programs, or opt-in for direct-earning of Qantas Points

Introduction

The Commonwealth Bank's Platinum Awards Mastercard now stands on its own, without a companion American Express card included on the same account – but how does that Mastercard stack up in 2019?

Australian Business Traveller looks under the hood of this Platinum-grade plastic to see whether its rewards and features are worth the cost.

Commonwealth Bank Platinum Awards Mastercard: fast facts

- Grade/tier: Platinum

- Card type: Mastercard

- Loyalty program: Qantas Frequent Flyer Direct or Commonwealth Awards

- Qantas Points earned per A$1 spent (Qantas Direct): 0.4

- Or, CBA Awards points earned per A$1 spent (CBA Awards): 1

- Points capping and restrictions: Earn up to 48,000 Qantas Points per year via Qantas Direct, or 150,000 CBA Award points per year with CBA Awards (equal to 75,000 Velocity points). No points are earned on ATO payments, however.

Airline and hotel transfer partners attached to CommBank Awards include:

|

Partner program |

Conversion rate from CBA Awards |

Partner earn rate per $1 spent |

|

Virgin Australia Velocity |

2:1 |

0.5 |

|

AirAsia BIG |

2.5:1 |

0.4 |

|

Air France/KLM Flying Blue |

3:1 |

0.33 |

|

Etihad Guest |

3.5:1 |

0.285 |

|

Japan Airlines Mileage Bank |

4:1 |

0.25 |

For example, a CBA Platinum cardholder enrolled in the CBA Awards scheme and converting their points to Velocity would earn the equivalent of 0.5 Velocity points per $1 spent using this card, given the 2:1 conversion rate from CBA Awards, and the initial earn rate of 1 CBA Award point per $1 spent.

CBA Platinum Awards Mastercard: fees, charges and interest

- Base annual fee: $249

- Additional annual fee if earning Qantas Points: $30

- Additional/supplementary cardholder fee: $10/year

- Interest rate on purchases: 20.24% p.a.

- Interest-free days on purchases: Up to 55

- Interest rate on cash advances: 21.24% p.a.

- International transaction fee: 3.0%

- Minimum income requirement: No defined minimum

- Minimum credit limit: $6,000

Earning points for free flights:

With a variety of frequent flyer programs awaiting your points conversions from Commonwealth Awards, most travellers will find Virgin Australia Velocity the most rewarding choice given the favourable 2:1 conversion rate from CBA Awards (0.5 Velocity points per $1 spent), versus other options that are only half as generous like United MileagePlus (0.25 United miles per $1 spent).

Although overseas-based frequent flyer programs like United can require fewer points to book flights compared with the Australian alternatives, the significant difference in conversion rates from CBA Awards negates most of those advantages, and could ultimately end up costing cardholders more of their hard-earned reward points to book their desired flight.

There's one exception: when you already have a large number of points or miles in one of those overseas partner programs, but don't quite have enough of them to book that goal flight. Making a small points transfer from CBA could top-up that account and make that reward booking possible, which avoids purchasing miles or even a full-fare ticket.

That said, customers who opt-in to Qantas Frequent Flyer Direct can only earn Qantas Points from their CBA spends, which are automatically credited to the cardholders' Qantas Frequent Flyer account every month.

Converting any existing CBA Awards points over to Qantas Frequent Flyer is not possible, so if Qantas Points are your goal, you'll need to opt-in before you spend on the card.

Commonwealth Bank is also offering 100,000 bonus CBA Awards points – that's 50,000 Velocity points via 2:1 conversion, or 40,000 Qantas Points for cardholders enrolled in Qantas Frequent Flyer Direct – for eligible new customers who apply by July 31 and spend $4,000 on eligible purchases by October 31 2019.

However, it should be said that many competing cards offer the same number of frequent flyer points per dollar spent yet with a much lower annual fee, like the St.George Amplify Platinum Visa, offering 0.5 Qantas, Velocity, Enrich or KrisFlyer miles per $1 spent, uncapped, with an annual fee of only $99, and no additional cardholder fee.

If you were already budgeting for $289 per year in annual fees – which you'd pay with the CBA Platinum card when earning Qantas Points and with an additional cardholder attached – for a lower $279/year (and reduced to $179 in the first year), you could instead be earning a much higher 0.825 frequent flyer points per $1 spent via St.George's higher-tier Amplify Signature Visa.

Airport lounge access:

Airport lounge access is not available via this card.

International travel insurance:

CBA's Platinum Awards Mastercard offers international travel insurance, but with a very significant catch: most of its cover is only unlocked when you remember to manually activate the insurance prior to each and every trip.

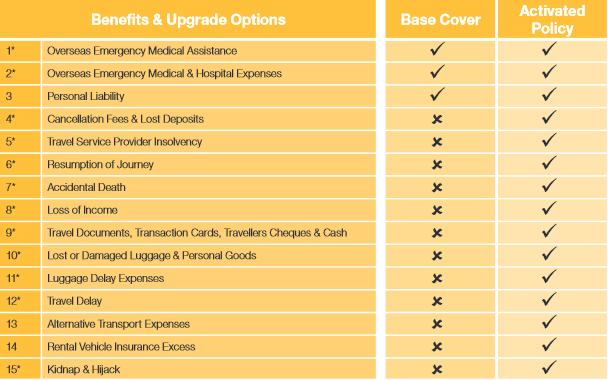

Unlike most other Australian Platinum-grade cards, this cover isn’t automatically activated when purchasing your airfares or pre-paying hotel accommodation using your card: if you don’t tell the bank where you’re travelling and when, you’ll only get overseas medical and personal liability insurance if you meet the policy's other criteria, rather than the full suite of insurance for things like travel delays, lost luggage or travel provider insolvency when opting-in:

If you've already departed Australia and forgot to activate the cover before the journey began, a three-day waiting period applies before the added perks kick in – during which time, you're barely covered.

However, this opt-in style of travel insurance could be beneficial for self-employed travellers jetting off on client--funded tickets or when travelling abroad on bookings made using frequent flyer points, as these types of bookings aren't always covered by credit card insurance: provided the traveller completes the activation process before each trip.

Commonwealth Bank Platinum Awards Mastercard: the verdict

The Commonwealth Bank has made many changes to its points-earning credit cards over the past few years – most recently, axing the companion American Express card attached to the CBA Platinum Mastercard, which previously offered no international transaction fees on overseas purchases.

Now with the AMEX deleted, CBA customers are slugged the standard 3% international transaction fee when shopping abroad, given the only CBA card available to them will be their Mastercard: and with an earning rate as low as 0.25 frequent flyer points per dollar spent, that amounts to up to 12c in bank fees for every 1 frequent flyer point earned, which is hardly worth the trouble: and that's not to mention the card's separate annual fee and additional cardholder fee.

Cardholders who instead make the bulk of their spends within Australia may appreciate the bank's clearer, fixed earning rates on that spend – compared to the previous system where points were earned at different rates in different places – but with CBA's Platinum card costing up to $289/year, there are more rewarding options available elsewhere at the same or lesser cost.

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

03 Nov 2014

Total posts 90

CBA credit cards are extremely poor value in my view. Earning rates are poor compared to others & there are no lounge passes etc. I’ve had one for years as it comes ‘free’ in te wealth package. The constant changes in the past were frustrating, but you’d be mad to hold the card & pay the annual fee...

Qantas - Qantas Frequent Flyer

06 Oct 2016

Total posts 161

Japan Airlines - JAL Mileage Bank

27 May 2019

Total posts 1

could you confirm for CBA credit card you don't need to buy anything with the cards?

04 May 2015

Total posts 262

Huh? Why would you have a credit card if you're not going to buy things with it?

01 Dec 2011

Total posts 29

I have a CBA p;atinum mastercard and I've just checked the annual fee--I paid $119 last August for a year. However, I'm wondering whether ir's worth continuing with QFF. Last year, I flew to UK with Oman Air for $4800 in J, whereas it would have cost around $6000 with EK, so it's hard to justify a high-fee card for points.

Qantas - Qantas Frequent Flyer

02 Jun 2016

Total posts 3

there are sign up bonus of 120000 points for CBA Diamond Award credit card but seems like audit not mentioning it anywhere. earning rate is $1 to 1.5 points, not bad

Qantas - Qantas Frequent Flyer

21 Jul 2018

Total posts 2

Actually ivanlai, Diamond only earns 1.25 CBA points per dollar. Which is 0.5 Qantas points per dollar. And is competitively abysmal compared to every other top-end Bank-issued card. I've got one with the mortgage, but I only use it for the insurance. For everything else its mediocre. CBA obviously don't care about competing with competitive offers from ANZ Black, Macquarie, NAB and Westpac.

Hi Guest, join in the discussion on Commonwealth Bank Platinum Awards Mastercard