Credit card travel insurance: what you need to know before you go

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Credit cards aren’t only useful for earning frequent flyer points: many also tout travel insurance among their endless perks, particularly those of the Gold, Platinum and Black varieties.

But the level of insurance coverage provided varies significantly between cards, including those from the same bank, which makes it important to check what your insurance will cover before relying on a credit card policy for your next domestic or international trip.

Insurance: domestic vs. international trips

With a few exceptions, most Australian credit cards provide full travel insurance only when you’re heading overseas, not merely flying within Australia.

Of course, your regular Australian health insurance and Medicare card are useful here, but a standalone travel insurance policy could cover you for extra things like public liability, theft of cash and travel documents or the costs of cancelling a trip early for health reasons.

Many cards do offer ‘interstate flight inconvenience insurance’ with a limited subset of cover for lengthy travel delays and tardy luggage, so even though you probably won’t be covered by the card’s regular ‘travel insurance’ policy, check to see if this interstate cover comes free with your plastic.

Activating your travel insurance cover

If your credit card does offer travel insurance, in almost all cases you won’t automatically be covered whenever and wherever you fly, and if you’re covered for one journey, you shouldn’t assume you’ll be covered for the next.

Along with simply having an eligible credit card, you’ll normally need to charge the cost of your return flights to that same card before your journey begins, in order to be covered.

This is something that often traps business travellers whose flights are booked via a corporate travel agent or who whip out the company credit card to cover the expense, in which case you’ll want to check your credit card’s policy, and if in doubt, pay for insurance the old fashioned way.

Some, but not all, credit cards will also cover you when booking trips using frequent flyer points earned on that card or through the same frequent flyer program where you usually credit your points, while others, like the Commonwealth Bank, require the manual registration of each and every trip.

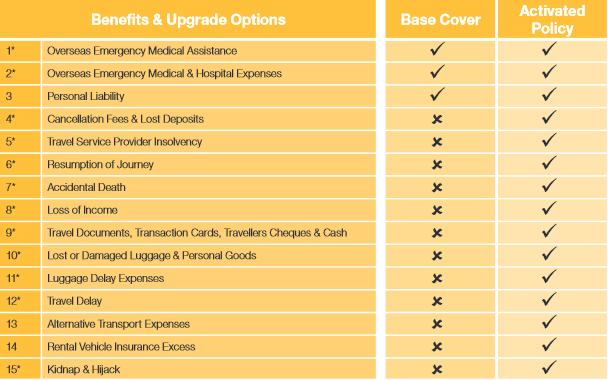

Forget to activate your full CBA travel insurance and you'll be left with only the most basic coverage on that particular journey:

Also read: Commonwealth Bank shakes up free travel insurance

As policies can vary, check which specific requirements apply to your credit card insurance before your journey begins and be sure to meet them if you’ll be relying on that cover.

Rental vehicle excess insurance: beware

Spanning both domestic and international journeys, many cards also cover you for the insurance excess payable in the event of a collision or claim in a hire car when the rental was charged or pre-authorised onto that same card.

Just be careful of that word ‘excess’ – in the United States, for example, the concept of an insurance excess is a rarity as for the most part you’re either insured fully for every penny or not insured at all.

In that instance, relying solely on your excess cover without taking out an actual policy to insure the hire car itself and you’ll have no insurance at all to fall back on.

That’s a dangerous position – nobody wants to return home thousands of dollars in debt after having a car accident – so when the rental agent offers you insurance, check what the excess amount will be. If there is none, kick your credit card cover to the kerb until next time.

Also read: Travel insurance: where do you stand with cancelled flights?

Follow Australian Business Traveller on Twitter: we're @AusBT

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Emirates Airlines - Skywards

30 Nov 2015

Total posts 730

I always take out and pay for insurance the old fashioned way, then I know what i'm covered for.

24 Apr 2014

Total posts 271

Beware that domestic cover usually means you have to fly to be covered. I claimed for theft once and satisfied all the conditions except that I did not fly to the destination. I did challenge the Insurer but got nowhere even though they saw sense in my argument that not everyone can fly, and that is why trains, buses and cars co exist.

Qantas - Qantas Frequent Flyer

10 Dec 2014

Total posts 60

While you are correct that with CBA you have to register each trip in advance, there are two big pluses over any other card I've seen: (1) You receive an actual certificate of insurance, so there is no question about whether you are covered, and (2) you don't need to have used the CBA card to pay for the trip (which is excellent for business travellers who don't use their own credit card to pay for the flights).

27 Jan 2016

Total posts 6

I disagree with the fact that you don;t have to pay using CBA credit card. I got caught with this last year and they advised me that claim is rejected as I have not spent $1,000 per person on the trip prior to leaving for my destination.

24 Apr 2012

Total posts 2441

CBA changed its credit card travel insurance arrangements from a spend requirement to a registration requirement on July 1 2015 – you'll find more information in the article linked above.

24 Apr 2012

Total posts 5

Commo Bank changed the policy last year so that you no longer need to pre-spend $1,000 per person, supposedly to accommodate people getting flights with reward points (I was told). However I find that the replacement policy seems much more "fragmented" by the exclusions and it seems more difficult to understand. And for some parts of it - such as interstate flight insurance - you DO need to buy the flight - but not taxes, fees, surcharges etc - with your "eligible" card.

16 Jan 2014

Total posts 2

Rental vehicle excess is covered only if you take excess insurance from car rental company.Make it useless. (CBA DIAMOND)

10 Aug 2015

Total posts 113

Domestic travel insurance is the way to go to avoid the car hire excess reduction surcharge.

Having just returned from 4 days Australian driving holiday, I paid $25 for 4 days cover which among many things included the excess reduction with Columbus. A significant reduction on the Hertz surcharge which would have been $150 (on a $215 car hire).

Hi Guest, join in the discussion on Credit card travel insurance: what you need to know before you go