AMEX Offers: how your American Express card can save you money

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

American Express cardholders can save hundreds of dollars each year by taking advantage of AMEX Offers: a free program open to most Australian AMEX users, whether their card is directly issued by American Express Australia, or by Commonwealth Bank, NAB or Westpac.

The concept is simple: most offers provide a cash reward in the form of a ‘statement credit’ when you spend a minimum amount at a specific business using your American Express card – with that rebate generally processed within a week of making your purchase, and which appears on your card just like a refund.

Sounds too good to be true? It isn’t: but you do need to activate each offer on your card before making a qualifying purchase, otherwise you won’t get any cash back.

Here’s what you need to know about the AMEX Offers program, including which cards are eligible, how to find and save deals to your card, how to trigger your cash rebates, and how to keep tabs on how much you’ve saved.

AMEX Offers: eligible American Express cards

The vast majority of Australian American Express credit and charge cards are eligible for AMEX Offers, including the popular Qantas Premium, Qantas Ultimate, Velocity Platinum, AMEX Explorer, Platinum Edge and Platinum Charge Cards issued directly by American Express Australia.

Also on the roster are the no-annual-fee Qantas Discovery, Velocity Escape and AMEX Essential credit cards – so if you don’t already have an American Express card, you can get one for free and start saving money via AMEX Offers straight away!

Joining those at the David Jones AMEX and the David Jones Platinum AMEX, and for business owners, the AMEX Business Platinum, Business Explorer, Qantas Business Rewards, Gold Business, (Green) Business, Velocity Business and Business Accelerator cards.

Business travel accounts, government cards, corporate cards, corporate purchasing cards, corporate meeting cards and prepaid cards issued directly by American Express Australia are ineligible, however.

From other banks, AMEX cards issued by CBA, NAB and Westpac are indeed eligible for AMEX Offers, covering products like the Commonwealth Awards AMEX range, NAB’s Qantas- and Velocity-branded AMEX cards and the Westpac Altitude AMEX lines.

It doesn’t matter whether your card is Classic, Gold, Platinum or Black: all that matters is that you have an American Express card: and if that happens to be a Westpac Earth or Singapore Airlines KrisFlyer-branded AMEX, that’s fine too, even though these cards aren’t available to new customers.

Finding and activating new AMEX Offers: AMEX-issued cards

Spenders with cards directly issued by American Express Australia (as opposed to CBA, NAB and Westpac) have the easiest access to AMEX Offers, as these appear in both the American Express mobile app and via internet banking.

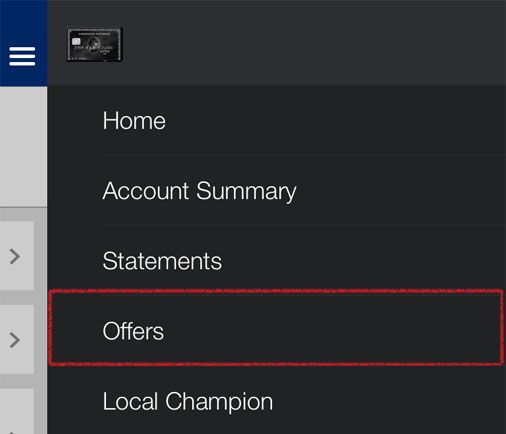

If you’re out and about, simply fire up that AMEX app, press the menu button and then click ‘offers’:

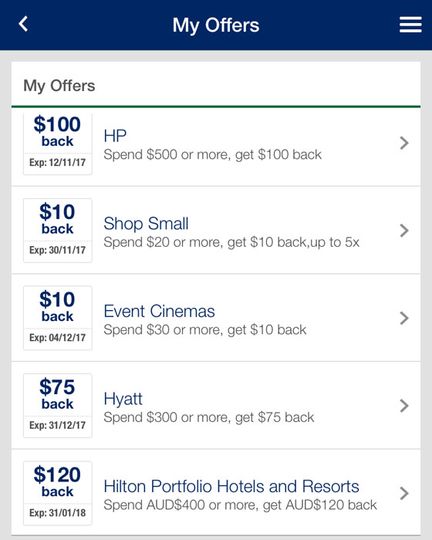

You’ll then see all the offers currently available on your card. Some will be open to all AMEX cardholders, while others can be targeted to certain cards or individuals: but if you see it here, you’re clear to enrol.

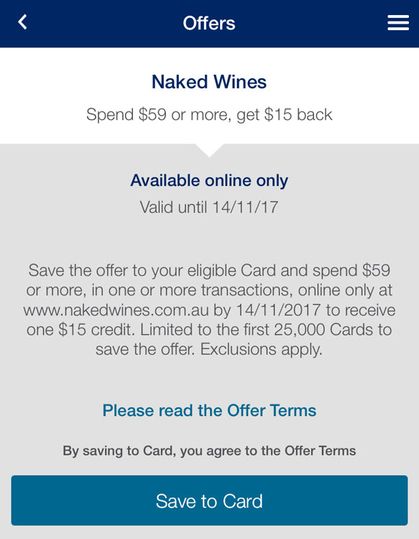

When you find something of interest, just click on the offer for the full details, including when you need to make your purchase by, and any special conditions that apply. In this case, a cardholder could save $15 when spending $59 or more at the Naked Wines website by November 14 2017.

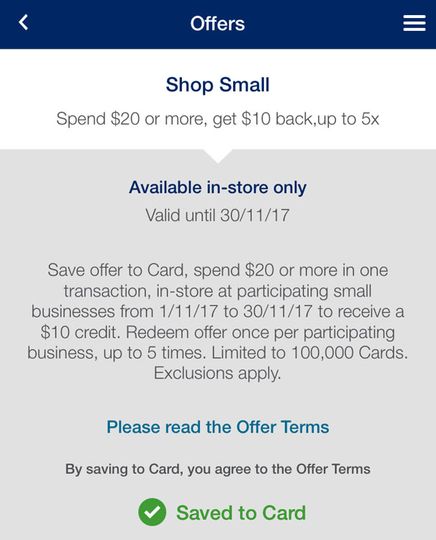

Here’s that crucial step – to complete the process, you’ll need to click ‘save to card’. When you see a green tick, you’re good to go.

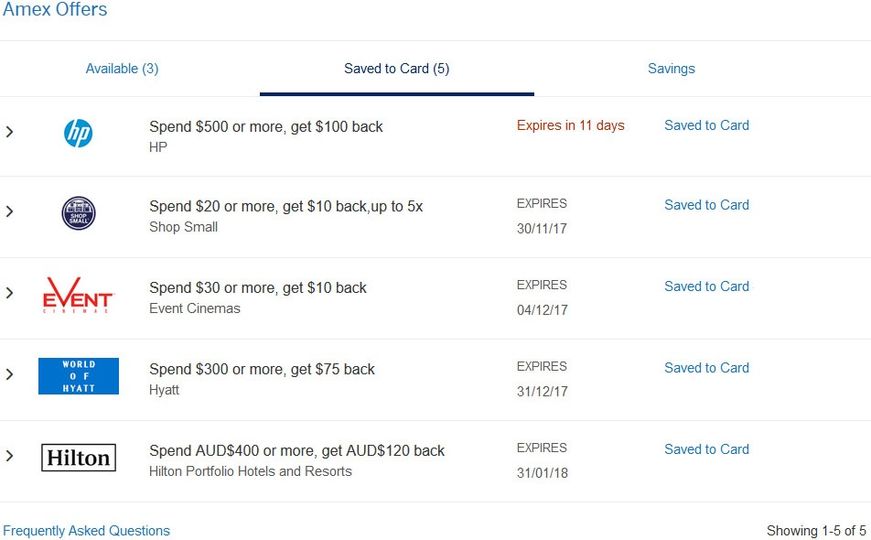

Among the great offers available right now, you could get $120 back when spending $400 or more with Hilton Hotels in Australia and New Zealand (when booking direct rather than via a travel agent), and $10 back up to five times when you spend $20 or more at a range of small businesses in your community via the Shop Small offer.

Prefer to bank on your desktop computer? Log into your American Express account via your preferred web browser, and on the main online banking page, scroll down until you see the AMEX Offers section, where the same features are available…

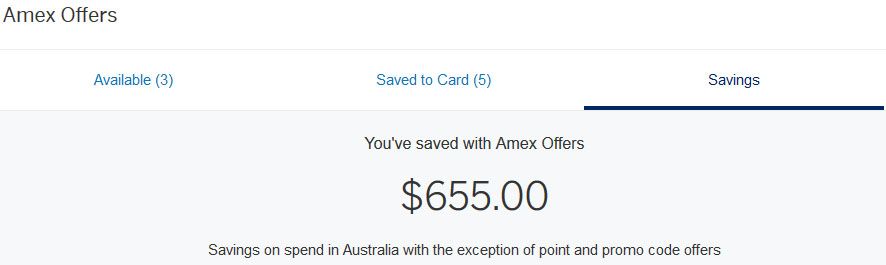

… but with the addition of a ‘savings’ tab, which shows just how much you’ve pocketed in statement credits from your chosen card:

Finding and activating new AMEX Offers: bank-issued cards

If your card is issued by CBA, NAB or Westpac, you’ll need to activate offers through the American Express Connect website instead.

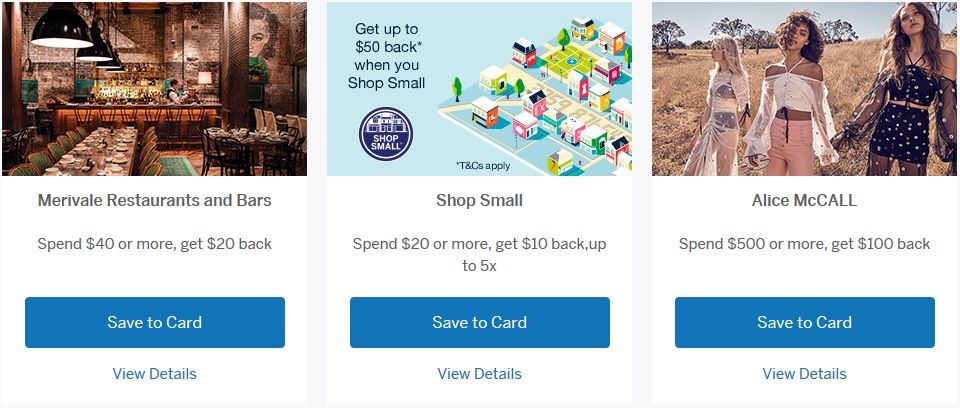

Simply visit the homepage where all the latest offers appear, and when you find one of interest, click ‘save to card’:

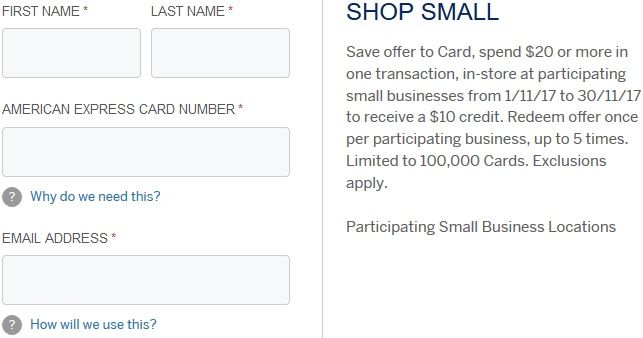

You’ll then need to key in your name, AMEX card number and an email address for each off you wish to register for:

Shoppers with cards issued directly by American Express Australia can also follow this path to register: it just takes more time than doing so through online or mobile banking.

However you register, you’ll usually get an email when making your qualifying purchase – and/or a push notification via the AMEX app – and your rebate will appear within a matter of days.

Tips for making the most of AMEX Offers

AMEX Offers can be popular, and in most cases, there’s a maximum number of cards that can register for each one. Once that number is reached, and anybody who hasn’t yet registered misses out on their chance.

With that in mind, a good strategy is to check your available offers whenever you’re using the AMEX app or are logged in to Internet banking, just in case something special pops up – and if you see an offer you like, don’t hesitate to save it to your card.

Also be aware that when you ‘save’ an offer, it’ll be saved for use with that particular American Express card only.

That means if you have two or more American Express cards, such as an AMEX Explorer and a Platinum Charge Card, if you save an offer to one card, it won’t be active on the other card, unless you specifically activate it on that card too.

(Savvy cardholders might do this to double-up on their savings, by putting the offer to good use not just once, but twice, courtesy of having multiple AMEX cards…)

The same concept applies to ‘additional cardholders’ on your account: unless their American Express card number is exactly the same as yours, they’ll need to register for their own offers independently – so a primary cardholder saving an offer onto their account doesn’t automatically make it available for use by an additional cardholder.

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Virgin Australia - Velocity Rewards

13 Jan 2015

Total posts 584

This is great but 95% of the time the offers are at places I don't/can't shop at anyway

Hi Guest, join in the discussion on AMEX Offers: how your American Express card can save you money